Our Team

Learn more about Southern Communities Initiative board members and team members who work to inspire change in the Southern regions.

Board Members

Robert F. Smith

Founder, Chairman and CEO, Vista Equity Partners

Founder, Chairman and CEO of Vista Equity Partners, Robert F. Smith is a philanthropist and entrepreneur who is dedicated to liberating the human spirit. Throughout Smith’s 35+ year career, he is committed his time and resources to initiatives supporting diversity and inclusion, culture, healthcare, the environment and education. The thought leader behind The 2% Solution, Smith partnered with some mission-aligned individuals to create the Initiative in 2021 to bridge the racial wealth gap in six Southern U.S. communities.

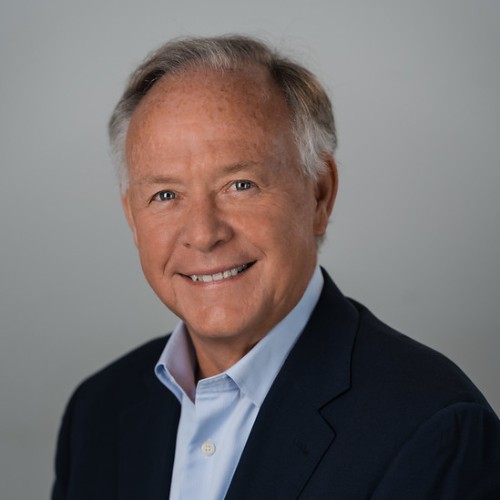

Rich Lesser

Global Chair, Boston Consulting Group (BCG)

Rich Lesser is the Global Chair of Boston Consulting Group (BCG). In the past, Lesser served as BCG’s CEO for eight years, a period of exceptional growth for the firm. As the CEO, Lesser oversaw the launch of several key business initiatives and programs, including BCG’s pledge to reach net zero climate impact by 2030.

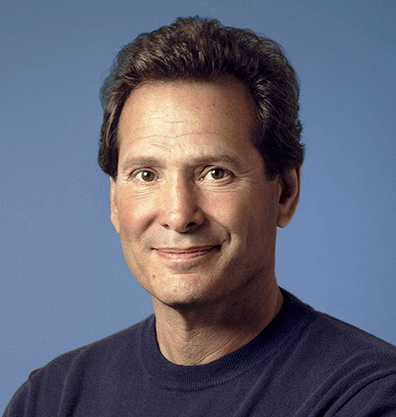

Dan Schulman

Former CEO of PayPal

Dan Schulman is the former President and CEO of PayPal. Under Schulman’s leadership, PayPal has helped transform how people move and manage money, as well as how merchants and consumers interact and transact. Since Schulman joined the company in 2014, PayPal has been named to JUST Capital and Forbes’ JUST lists for top companies. PayPal has also been recognized as a Fortune Change the World company thanks to its commitment to tackling some of the biggest societal challenges.

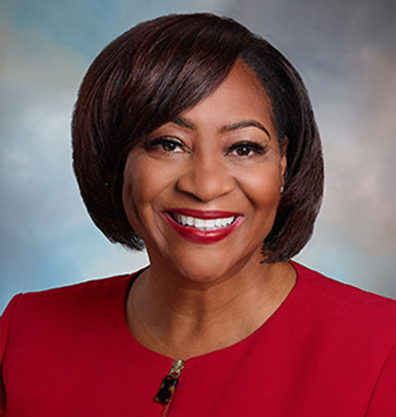

La June Montgomery Tabron

President and CEO, W.K. Kellogg Foundation

La June Montgomery Tabron is president and CEO of the W.K. Kellogg Foundation in Battle Creek, Michigan, one of the largest private foundations in the United States. Since joining the W.K. Kellogg Foundation in 1987, Tabron has risen to become the organization’s first woman and first Black American chief executive, leading work to support thriving children, working families and communities. Currently, Tabron serves on the Kellogg Company board and chairs the W.K. Kellogg Foundation Trust.

Southern Communities Initiative Team Members

Usman Ahmed

Principal, SCI – Head of Global Public Affairs and Strategic Research, PayPal

Ami Desai

Principal, SCI – Chief of Staff to Founder, Chairman, and CEO Robert Smith, Vista Equity Partners

Ross Comstock

Principal, SCI - Vice President, Information Systems and Technology, W.K. Kellogg Foundation

Rhea Williams-Bishop

Principal, SCI - Director of Mississippi and New Orleans Programming, W.K. Kellogg Foundation

Justin Dean

Principal, SCI – Managing Director and Sr. Partner, Boston Consulting Group (BCG)

Joe Davis

Principal, SCI – Managing Director and Sr. Partner, Boston Consulting Group (BCG)

Marisa Gerla

Principal, SCI - Managing Director and Partner, Boston Consulting Group (BCG)

Suzanne Skipper

Principal, SCI - Managing Director and Partner, Boston Consulting Group (BCG)

Join Us and Get Involved!

If you are interested in partnering with Southern Communities Initiative or wish to volunteer your time, we invite you to explore the different ways you can engage.